When I talk to people about debt, many frequently state they don’t have any, telling me they don’t have any credit card debt or student loan debt. I congratulate them on having neither, but then ask about auto loans and if they have a mortgage. Their answers are striking, but not uncommon. Regarding auto loans, I’m often told they’ll always have one, since by the time the loan is paid off, their car has over (or nearly) 100,000 miles on the odometer and it’s time for a new car. I’ll save my answer to that (and solution!) for another post, but rest assured, there’s a much better way to buy a car than taking on yet another auto loan.

The bigger question is whether or not most believe their mortgage is an actual debt. Surely, most have heard there is a difference between “good” debt and “bad” debt; good debt being they type which can be leveraged to generate a higher return than the interest being charged. For some, this can mean taking out a loan at today’s low rates and investing the cash in an investment where the potential is a much higher return. Bad debt is referred to as cash which is borrowed for consuming goods which depreciate in value almost immediately. So, which is a mortgage?

It can be argued that, historically, when a consumer buys a house, the value will, over time, appreciate much further beyond the amount borrowed while the mortgage is being paid off. This is referred to as “unrealized gain”, to which it becomes “realized” when the house is sold. In this scenario, it’s hard to argue that a mortgage is “bad” debt. But what if, as in during the Great Recession, a consumer buys a house only to see its value fall due to any number of economic reasons. The debt doesn’t feel so “good” any longer, since that homeowner is now underwater, owning significantly more than the house is worth.

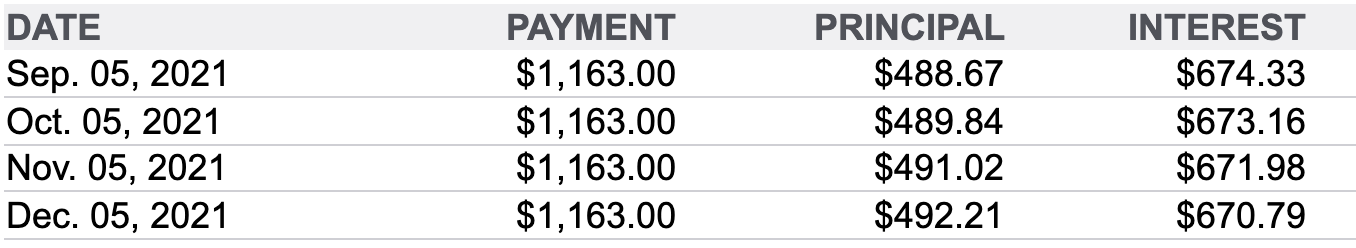

So the question stands; should you pay off your mortgage? To answer that, let’s take a look at a hypothetical mortgage, courtesy of bankrate.com. In this scenario, a typical home price of $350,000 is used, with a down payment of 20%, which leads to an outstanding 30 year mortgage of $280,000 at 2.89%. Principal and interest for our loan totals a monthly payment amount of $1,163.00 (no escrows for taxes and insurance). I think you’ll agree that 2.89% is a fantastic rate, as we’re at current historic lows for mortgage rates. But let’s take a look at what percentage the interest per payment ACTUALLY is at any given time in our mortgage’s amortization schedule.

As you can see, assuming the mortgage was taken out today (8/5/21), the first payment is Sept. 5, 2021. Since the interest on the payment is $674.33, interest is approximately 58% of that payment! Even at the end of the calendar year (December’s payment), interest is approximately 57.5% of that payment.

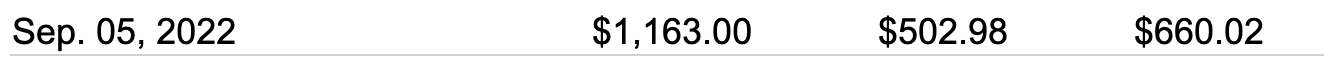

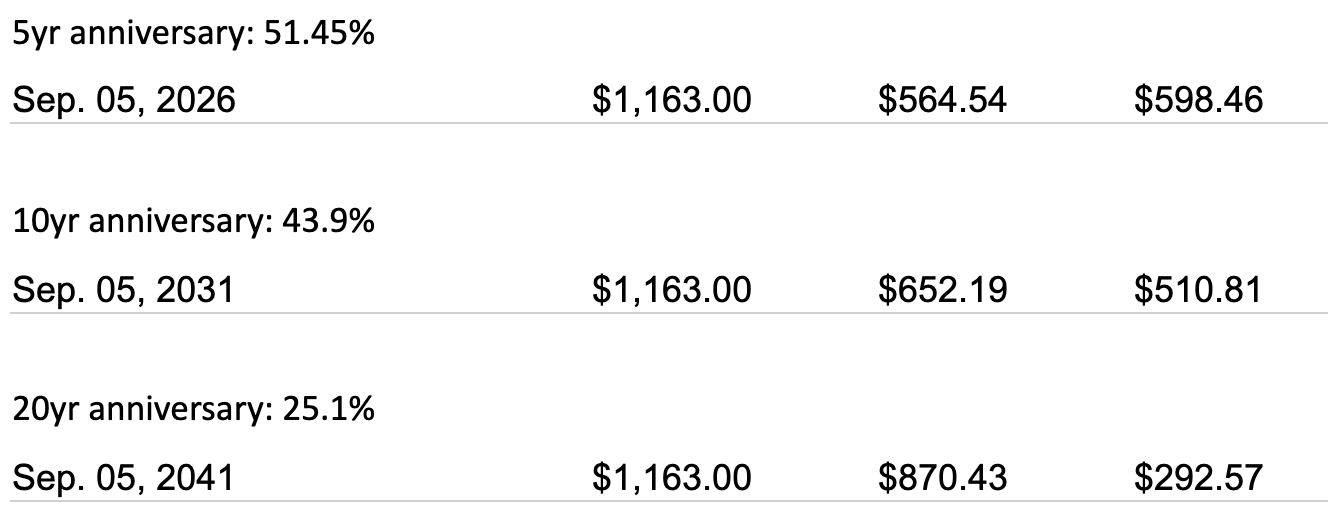

At the one year mark in our mortgage (9/5/22, above), interest still comprises 56.7% of the total payment! Take a look below at the interest bite at the five year anniversary, ten year anniversary and twenty year anniversary. They are as follows:

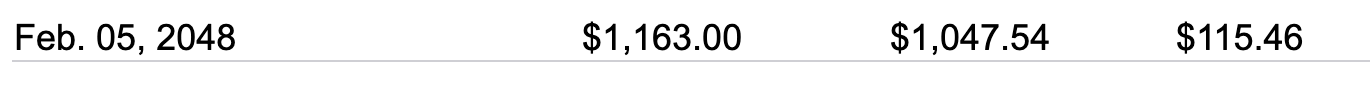

It isn’t until well into year 26 (February 5, 2048) that interest on the monthly payment falls to under 10% (9.9%). I believe it’s safe to say most people don’t stay in any one home for that length of time.

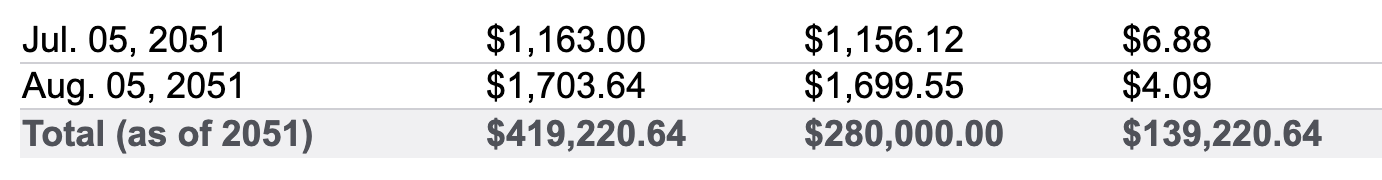

In fact, if our mortgage is held to payoff (8/5/51), total interest paid would be $139,220 for a total outlay of $419,220! Total interest on the original mortgage amount of $280,000 is approximately 49.7%, almost half again as much as the original mortgage!

So the question remains: is a mortgage “good” or “bad” debt. My opinion is that anytime interest paid is almost half again as much as the original principal, that debt can’t be good and should be paid off as quickly as possible. Surely the interest saved could be utilized more efficiently in order to build additional retirement income.

Although this is a broad overview of a hypothetical mortgage, If you’d like to learn more about how to pay off your mortgage in 9 years or less (on average), please contact me at d.babecki@db3insuranceservices.com or give me a call at 941-704-3134. As always, thank you for reading and let me know how I can be of service.

About David J Babecki

David Babecki is the Owner/Founder of DB3 Insurance Services and has over 20 years of experience in personal insurance, proudly protecting clients against outliving their money, stock market risk, and of course, insuring their lives against the unforeseen.

David started his career with Raymond James & Associates in 2000 before becoming an independent agent where he offers a number of services to solve client needs. David has spent the majority of his life in the beautiful Tampa Bay area where he currently resides with his family.

David is a Licensed Life Insurance Agent FL # D053146

The above article reflects the opinions and thoughts of David J. Babecki. The information contained in this material is believed to be reliable, but not guaranteed. It is for informational purposes only and is not a solicitation to buy or sell any products which may be mentioned. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.

Please note: all guarantees and/or promises are based on the claims-paying ability of the respective insurance company.