Welcome to my blog, from which I’ll be writing a weekly article that I hope will be of interest to you! If you’ve connected with me via LinkedIn or Facebook, I thank you and will strive to respect your time by writing about subjects of value. So, let’s get to it….

It may seem a bit strange for an insurance agent to write about debt, as the correlation may not exactly be clear. Indeed, on my website, the traditional forms of insurance are listed (and explained). However, since debt can be (and truly is) a problem for individuals, businesses and governments, I’ve made it one of the focuses of my practice. Only when a plan is in place to eliminate it can we operate from a position of strength and proceed with sound life planning.

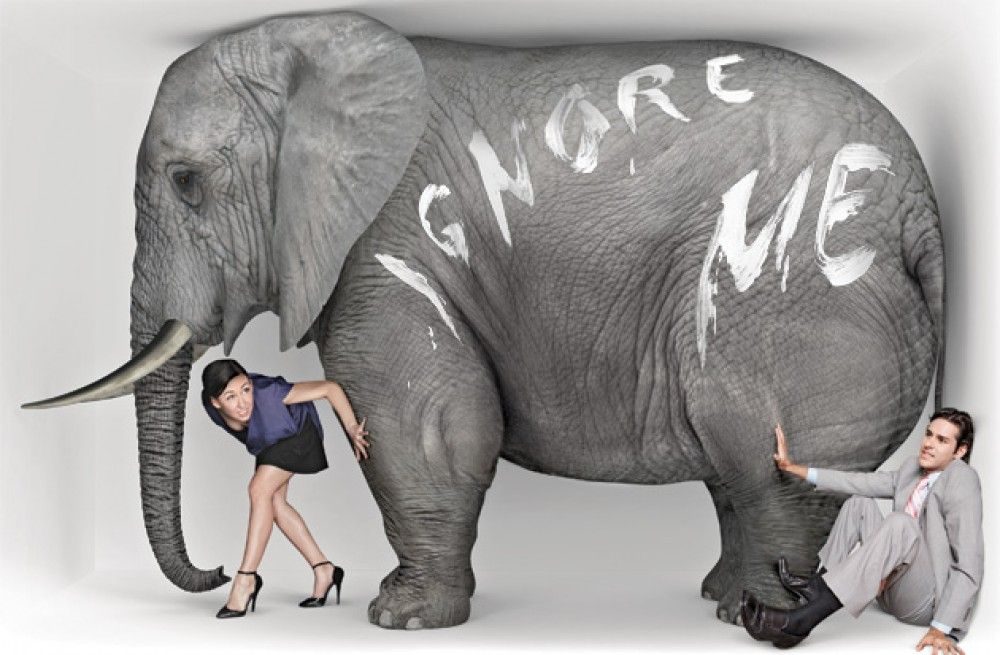

For the most part, debt is the nine hundred pound elephant in the room to which no one wants to acknowledge and it’s understandable as to why. We feel good when we’re able to purchase items we value on time, as a form of immediate gratification. However, what really happens is we’re stealing from our future assets and/or income. The true cost of the item(s) that we’re enjoying could very well mean putting off (or completely avoiding) things like saving for retirement, college planning and business expansion. Clearly, this is true for individuals, businesses and governments alike and happens across all tax brackets.

To illustrate the point of debt, I’ve added a link on my site (under the YFB Debt Free Concept), which leads to the US Debt Clock, but you can also access it here: www.usdebtclock.org.

If you’ve never looked at this site, it can look a bit intimidating, since there’s a ton of information. And if you’re not a numbers person, it can get blurry pretty quickly! However, there are a few items of interest that do jump out: The US National Debt (total debt owed by the US government), which stands at over $28T, which means EACH individual’s share of that debt is approx. $85,000. The Federal Debt To GDP Ratio, which measures this debt against to total production of the US economy (Gross Domestic Product). This number is currently over 130%, which means Uncle Sam is spending more than the US economy is generating.

Scrolling down a bit brings us to Student Loan Debt (over $1.7T, approximately $38,000 per student) and Credit Card Debt (approaching $1T!). These numbers are concerning, since they usually have variable interest rates attached to them. Higher interest costs mean either higher payments for the same duration or longer durations at the same payment.

So what does all this debt mean and how does it apply to you? Since the economy is coming back (vaccinations are in full swing, jobs are being created per last week’s employment report, consumer spending is increasing and interest rates are extremely low, leading to a red hot housing market), what could be the downside? Higher interest rates, which are tied to either inflation or higher bond yields. Basically, higher rates due to inflation happen because too many consumers are chasing too few goods. This tends to drive prices up, which can lead to an overheated economy. An overheated economy is then addressed by the Federal Reserve by raising the borrowing rate between banks; in effect, throwing cold water on the economy, since the banks then raise borrowing costs for consumers, affecting everything from mortgages, to auto loans, to credit cards, to variable loans. If a debt is financed with a variable rate (credit cards, lines of credit), the cost of that debt will undoubtedly go up, thereby having an increasingly negative effect on the household/business budget.

The bond market is another reason rates could rise. In this scenario, if bond buyers are concerned about a government’s (or company’s) ability to pay on its obligations (due to its outstanding debt or lack of revenue it’s bringing in), they will demand more compensation (interest) for the risk they’re being asked to take, thereby asking for a higher interest rate. Another reason is if bonds are being sold en masse; a lower selling price means higher yields.

Having said all that, which scenario leads to higher rates is unknown at this time. However, with rates probably not going anywhere for the time being, now is a great time to eliminate debt, either personal or business. Doing so will translate into a position of strength by increasing net income, planning for emergencies and taking advantage of opportunities when they occur. Let me know if I can help.

I hope this first post has provided value to you. I encourage feedback and hope you continue to read! Take care.

About David J Babecki

David Babecki is the Owner/Founder of DB3 Insurance Services and has over 20 years of experience in personal insurance, proudly protecting clients against outliving their money, stock market risk, and of course, insuring their lives against the unforeseen.

David started his career with Raymond James & Associates in 2000 before becoming an independent agent where he offers a number of services to solve client needs. David has spent the majority of his life in the beautiful Tampa Bay area where he currently resides with his family.

David is a Licensed Life Insurance Agent FL # D053146

The above article reflects the opinions and thoughts of David J. Babecki. The information contained in this material is believed to be reliable, but not guaranteed. It is for informational purposes only and is not a solicitation to buy or sell any products which may be mentioned. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.